CREATIVE YIELD-ORIENTED REAL

ESTATE INVESTMENT FIRM

ABOUT US

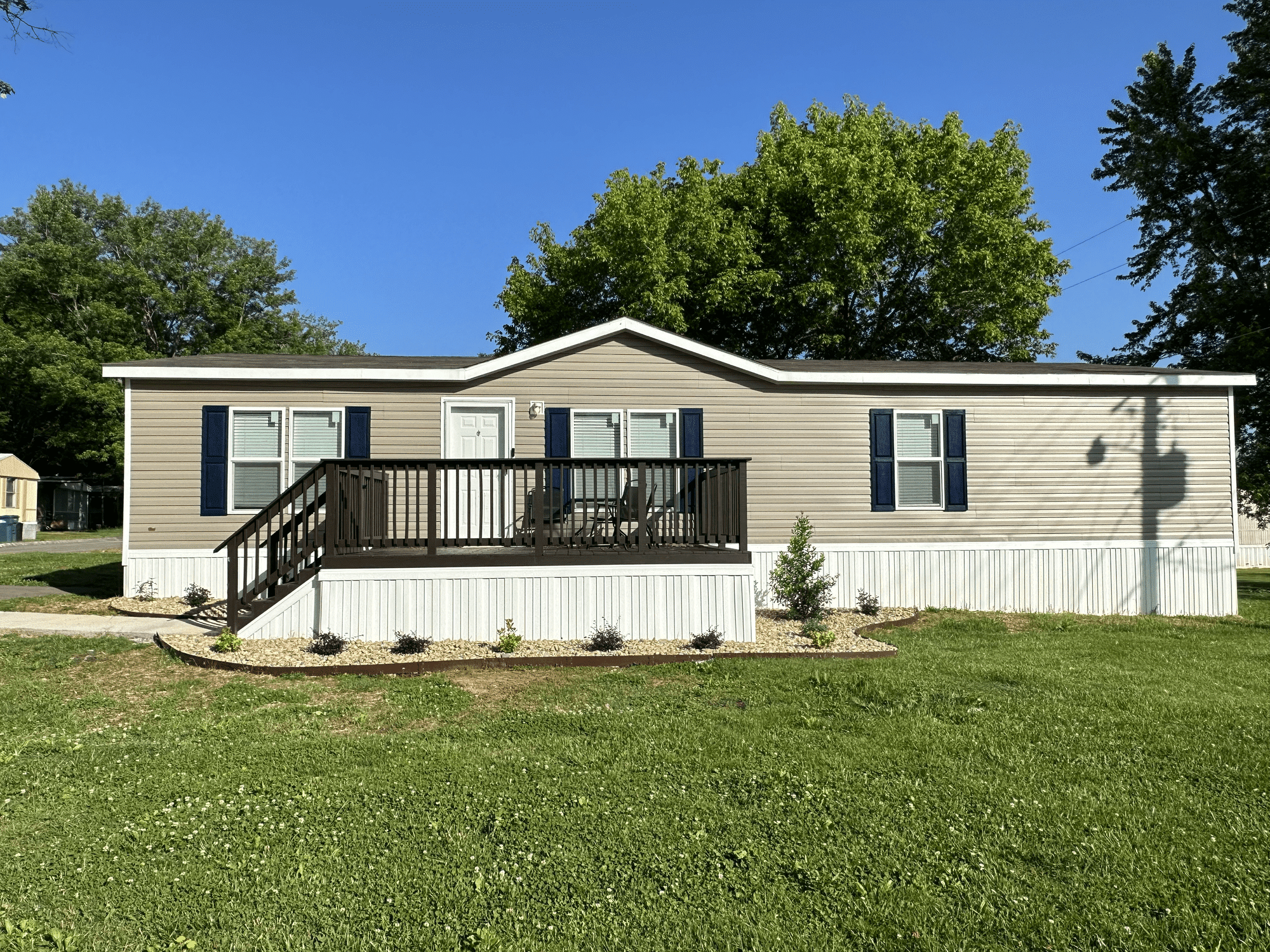

Stonetown Capital Group is a Denver-based, real estate investment firm focused upon opportunities in the manufactured housing and recreational vehicle sectors. The principals of Stonetown have deep real estate private equity experience both domestically and abroad and have built a top tier investment group.

The company has raised approximately $750 million in private equity capital since inception over a series of investment vehicles. Our current funds, Stonetown 7 and Stonetown Development Ventures, have approximately $200 million of committed capital which we are actively investing.

Investment Platforms

Stonetown actively invests in affordable housing primarily in the manufactured housing space. Leveraging deep real estate experience in acquisitions, dispositions, joint ventures, restructurings and financings, Stonetown has a unique ability to identify value, structure deals, close transactions and execute on a variety of business plans.

Our Strategy

Stonetown seeks yield-driven real estate investments believing that cash flowing properties offer more attractive risk adjusted returns. Stonetown’s strategy is to apply its team’s institutional training and background to a unique, real estate vertical.

Our Mentality

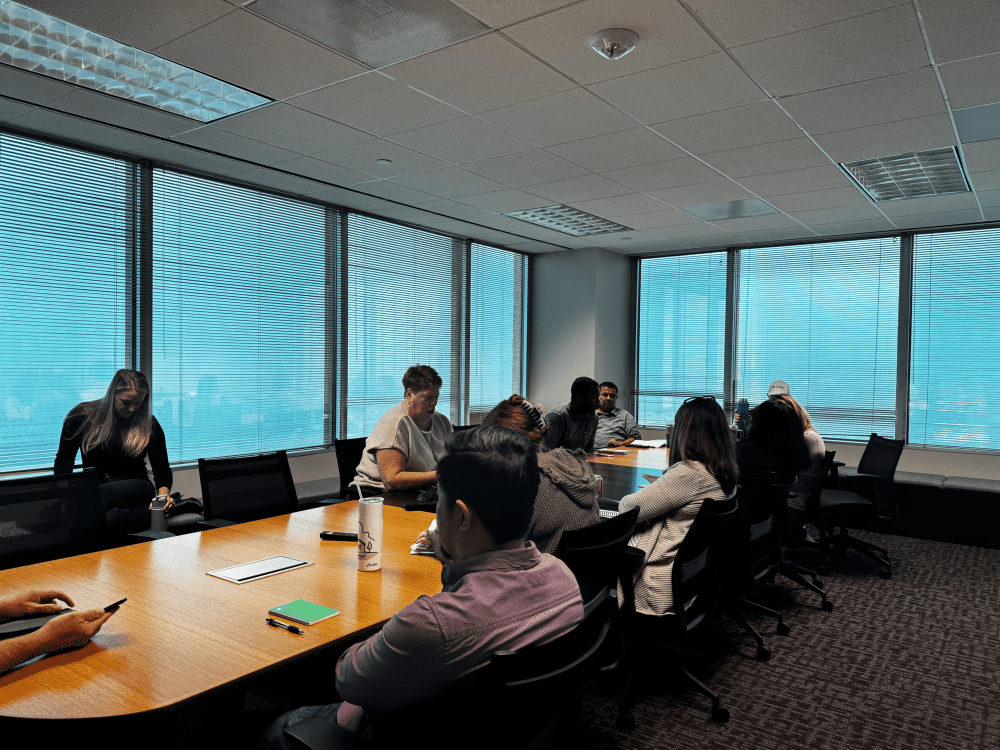

Stonetown is a Denver-based company with an active office in Houston. We have a collaborative, office-focused culture that emphasizes a work hard, play hard mentality.